Video Conference/Courier Instructions

The ITIN Application Form W-7 is complex

We have done everything we can to streamline this process for you after handling 800+ successful applications. Our goal is for you to be able to get an ITIN, not a rejection letter or a delay. To meet this goal, we need your help! Below we point out (hopefully nicely) where you might introduce a mistake that causes a processing error. We ask you to please follow the instructions carefully and ask questions along the way if you feel uncertain about anything.

Step One - check your personal details on the form W7

Please check your name and address. We’ve used your passport or other identity documents to proofread date and place of birth and document numbers. Tell us if something needs to be changed.

Step Two - leave the tick boxes alone

Each tick box triggers specific supporting documentation. We’ve interpreted the rules according to the information you provided. If you disagree with the selected reason, tell Christine Dahl rather than changing the form. If you change the reason (and the tick box), we need to change the supporting documentation.

Step Three - print the application and sign it with ink

The IRS does not accept e-signatures on ITIN Applications. 🦕🦕🦕 They require humans to apply ink to paper.

Sign in ink

The IRS requires a real (“wet”), original signature. It rejects e-signatures, electronically applied signatures.

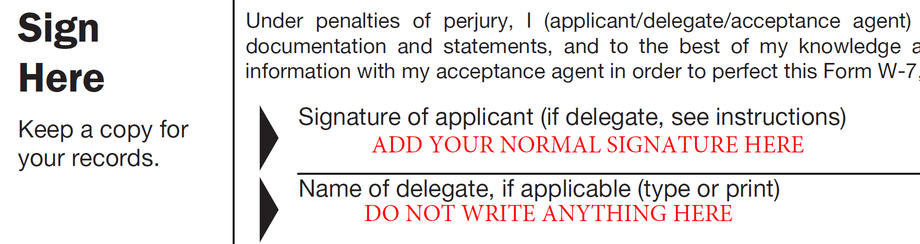

Where do I sign?

On the line below the words Signature of applicant.

Write your name below your signature ONLY IF you’re a Delegate, meaning that you’re signing someone else’s application for them.

Step Four - Assemble and Sign the Supporting Documents

Depending on the reason for your application, you will need a specific type of document.

If you formed a new company in the US, we will need an original, signed letter from the company to the IRS requesting an ITIN.

- COMPANY LETTER - needs to be on letterhead. Feel free to change the sample we’ve prepared. But don’t change the text, which follows the IRS-approved template

When you mail the signed W7 form to us, please include your supporting documentation (also original, also signed in ink).

Our Mailing Address

Before shipping to us, check with Christine to be sure she’s in The Hague (not traveling).

Dahl International

Hoge Nieuwstraat 18

2514 EL Den Haag

Netherlands

Step Five - Identity Conference

When your materials arrive, CAA Christine Dahl will call you for a short video conference and return your passport within one business day. We’ve found WhatsApp or Vectera to be easier than scheduling a Zoom meeting in advance.

If your return address differs from the address on your application form, please tell us where you want your passport returned.